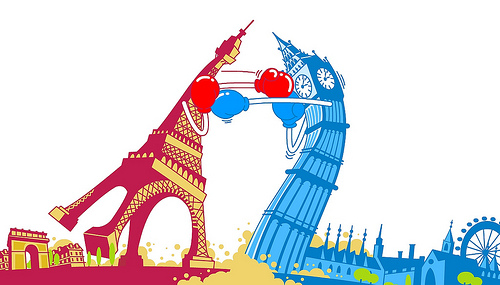

Paris – the new European leader on the property investment list

The global property adviser CBRE reports that Paris has overtaken London at the top of the chart for property investment in Europe. Another change in the top 10 is Moscow coming up sixth before Berlin.

The global property adviser CBRE reports that Paris has overtaken London at the top of the chart for property investment in Europe. Another change in the top 10 is Moscow coming up sixth before Berlin.

Significant increase of investments in the final quarter of 2011 was registered in Paris, from €3.6 billion in the first half of the year to €7.9 billion in the second half, resulting in the first change of the leader of the ranking since it was first compiled in 2004. The difference was slim though, investment in central London in the second half of 2011 was €7.8 billion, but still lower than the high total recorded in the second half of 2010.

Most investments in France were towards Paris, especially in the office sector and for single asset deals. The French real estate investment market as a whole also recorded very vibrant activity of €6.5 billion in the final quarter of 2011, which was higher than every other European market except the one in UK, which saw an estimated €8.3 billion of investment activity.

Although some investors have been turned away from the EU markets because of the sovereign credit rating downgrades and the lack of a solution to the Eurozone crisis, the Paris and Central London markets remain central to foreign investment. This proves the enduring attractiveness of Europe’s key cities.

The top 10 is completed by three German cities: Munich, Frankfurt and Berlin, reflecting the strong economic growth that has been seen in Germany over the last couple of years. Another German city, Hamburg, was eleventh on thelist.The Nordic region was represented with three cities as well: Stockholm, Oslo and Copenhagen, with prominent investors from Australia and Canada.

Last but not least, strong investor interest in the Central and Eastern European (CEE) region has resulted in both Moscow and Warsaw finding place in the top 10. Since 2008, there was a tendency for foreign investors to abandon Russia, which is why domestic investors account for the majority of commercial real estate investment. However, according to expert predictions, once foreign investors start returning to Russia, its place in the ranking will go up.

Total investment activity in Europe reached €118 billion in 2011, which recorded a small increase of 7% compared to 2010. Direct commercial real estate investment in the second half of 2011 reached €62.9 billion.

Russian

Russian Bulgarian

Bulgarian English

English Spanish

Spanish German

German